The importance of financial literacy

- Title

- The importance of financial literacy

What was uncovered was that unfortunately, few Australians claim that they are fully satisfied with their financial situation with only 22% indicating they are extremely/very satisfied with their financial situation, while over half 55% are somewhat/slightly satisfied, and 22% report not being satisfied at all with their financial state.

Younger males are much more likely than younger females to be extremely or very satisfied with their current financial situation (24% Gen Z males, 44% Gen Y males compared to 10% Gen Z females, 19% Gen Y females). More than half (58%) strongly/somewhat agree they want to manage their money better. This desire is translating into behavioural change, with 63% dedicating more focus to increasing their financial knowledge compared to 12 months ago.

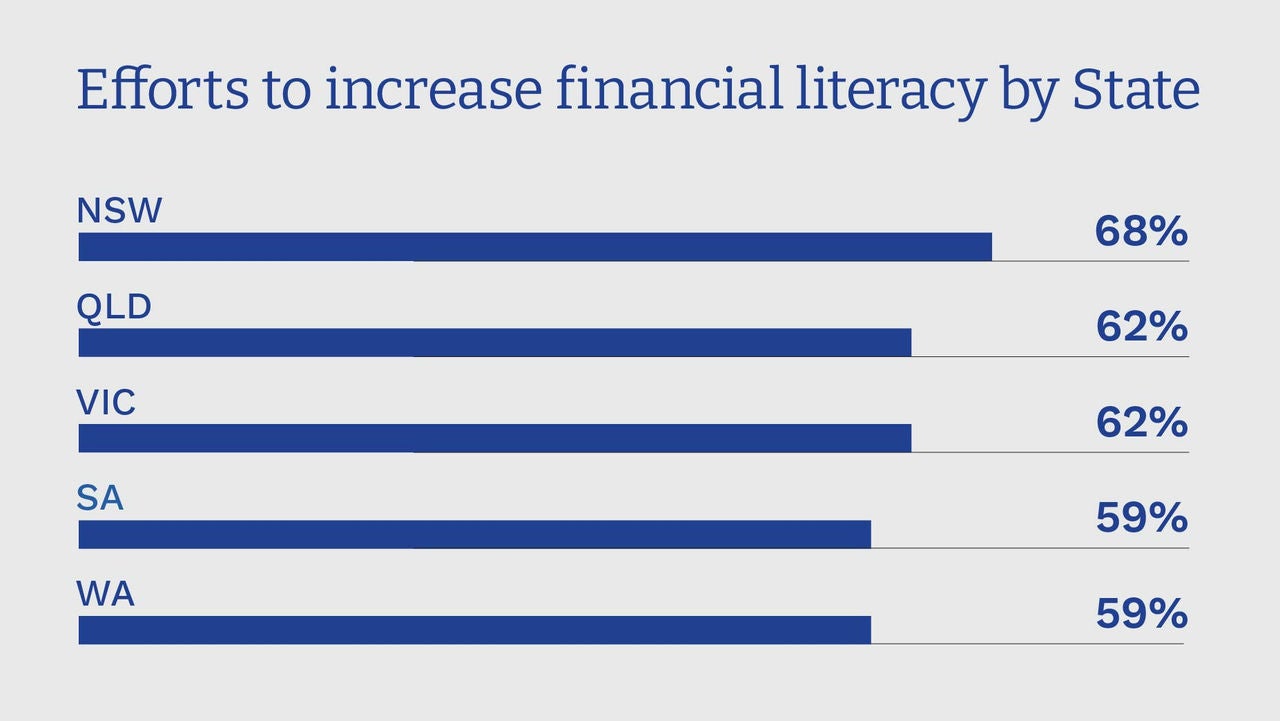

This includes 29% of Australians who are dedicating much more focus to increasing their financial knowledge. Across the states, people in New South Wales are most likely to be putting additional energy into increasing their financial knowledge compared to 12 months ago.

Financial literacy shapes the relationship people have with money, so in order to cultivate a positive relationship, it’s important Australians receive helpful financial education throughout their life, but crucially in their youth. Yet 31% report receiving no financial education in their childhood, and 57% receive a small or fair amount. Just 13% received a lot, or an extensive amount of financial education in childhood.

Concerningly, it’s younger females who report receiving no financial education in childhood (20% Gen Z females, 28% GenY females compared to 11% Gen Z males, 14% Gen Y males). As they entered early adulthood, 40% of Australians indicate receiving no financial help, and 49% report receiving limited or some financial help.

Certainly, many Australians would have appreciated more financial education in their younger years to enable them to make more informed financial decisions.

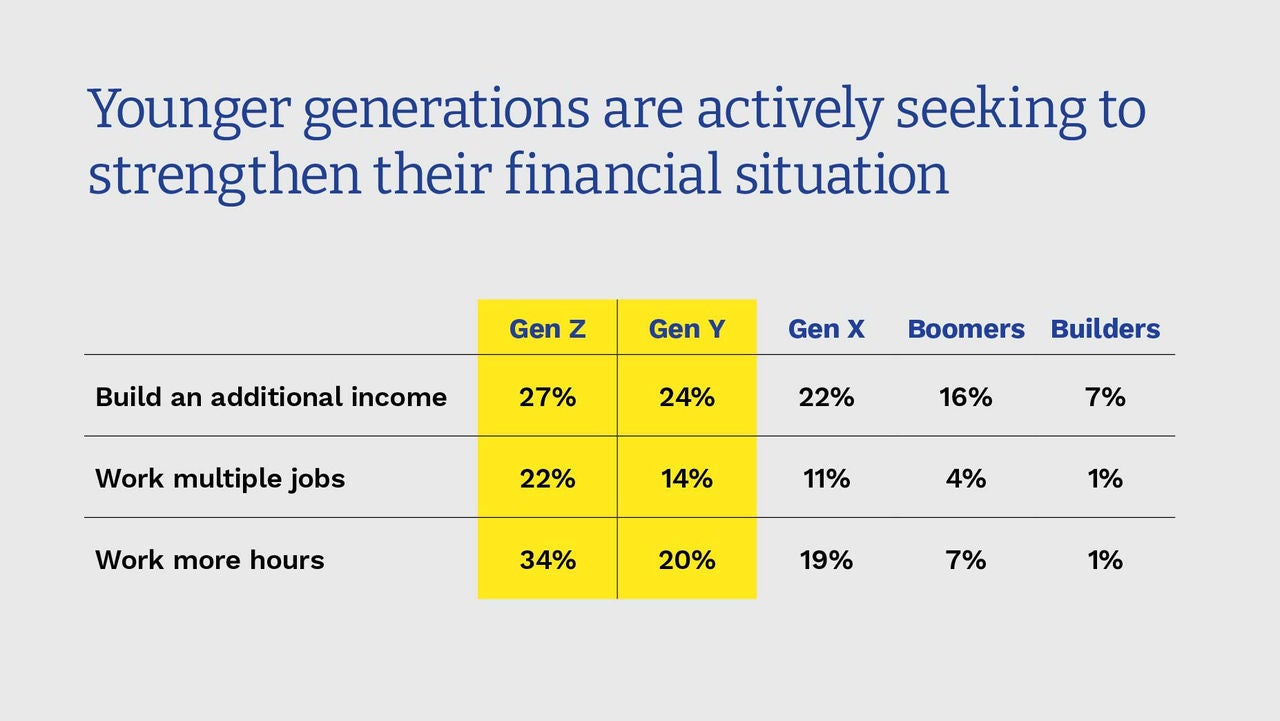

Aware of the challenges that lie ahead, Australians are open to improving their financial knowledge to strengthen their financial status. Young Australians are more driven than their older counterparts to attain financial literacy as they are wanting to look for sources to improve their financial knowledge, with younger females being the most likely to strengthen their financial situation by looking to improve their financial knowledge (29% Gen Z females, 30% Gen Y females compared to 25% Gen Z males, 21% Gen Y males).

Across the generations, Gen Z is the least prepared to navigate any unexpected financial challenges, with 14% feeling not at all prepared and 24% feeling only slightly prepared. When it comes to improving their financial situation, Gen Z is most open to resorting to having a budget (56%), cutting back spending on non-essential items (50%), having a separate savings account (48%) and shopping around for the best deals (43%).

Gen Y is similarly resorting to having a budget (49%), cutting back on non-essential items (47%), shopping around for the best deals (43%) and having a separate savings account (43%).

While these are all appropriate and helpful financial habits to develop, they may not necessarily be the most effective strategies for cultivating long-term wealth.

The top measures Australians say would help them feel more confident in navigating financial challenges are having an emergency fund (37%), developing good financial habits (28%) and flexible payment options (25%).

Evidently, there are opportunities for Australians across the board, but especially younger Australians, to improve their financial literacy so they’re able to achieve their dreams of financial wellbeing.

At Bridges, we are passionate about helping every Australian feel more confident about their financial situation and supporting financial education at any age.

We have tools to help you better understand your current situation, and one meeting with us can give you greater confidence that we can help you better manage your money at any age.

Read the full Financial Freedom report.

If you know someone who would benefit from a financial guide at their side, please get in touch.